Market Segmentation: Don’t Let It Become an Afterthought

By Nick Pompeo, Sales and Go-to-Market Lead at WestCap

The concept of market segmentation is not new. The practice involves dividing potential customers into subgroups based on characteristics such as geography, buying habits, use cases, pain points and other factors. This helps companies identify their target audience and tailor content, products and selling tactics accordingly.

While most B2B companies prioritize market segmentation as they’re getting off the ground, the level of focus on this fundamental strategy often falls by the wayside as they grow. That’s a mistake — one that many are learning the hard way in this current period of economic turbulence. It’s crucial for leaders of B2B companies — regardless of size or the macroeconomic environment — to continuously track, analyze and iterate on their market segmentation strategies.

Why a robust approach is critical

When founders are launching startups, market segmentation is a central focus. Defining target customers and ideal customer profiles is key to establishing product-market fit and obtaining early-stage financing. But over time, the strategy tends to get watered down. Young companies typically chase every lead and win every customer they can, regardless of whether they fall within defined target segments. This helps companies ascertain market feedback and identify where they have product-market fit.

As startups gain traction and revenue, leaders decide, often subconsciously, that they intuitively know who their ideal customers are and dismiss segmentation exercises as rudimentary. Or they convince themselves that other activities and initiatives are more important. But the longer companies make market segmentation an afterthought, the more of a problem it can become.

There are several reasons that ignoring market segmentation is a bad idea. First, the landscape is constantly evolving: a company’s products, its buyers, its competitors and the broader market. What worked months or years ago may no longer apply, and businesses need to keep a pulse on where and how their value proposition is resonating. If they’re too complacent, emerging competitors can gain market share by excelling in messaging, positioning or pricing, even if their products are inferior. And, as most leaders know, it’s much costlier to win a new customer than to retain an existing one.

Another potential pitfall is a lack of internal alignment across functional teams. Without a clear picture of the ideal customer, Marketing, Sales, Customer Success, Product and Professional Services may be out of sync, leading to wasted time and resources. Getting on the same page means Marketing can target the right customers, Sales can deliver the right messaging, Product can develop the right features, Professional Services can implement the right onboarding strategy and Customer Success can be adequately prepared to serve clients.

B2B companies that fail to revisit their market segmentation strategies may realize they’ve been casting too broad a net and wasting resources on segments that are no longer a good fit, or never were. That mismatch can be damaging — and potentially fatal in a tough economy, when customers are cutting “nice-to-have” solutions that don’t meet critical needs. In any market, spending too much time on low-margin, low-growth opportunities cuts into efficiency and profitability. Even if a company is winning with a variety of customers, they’re losing out if they’re not paying attention to where they’re achieving the highest ROI.

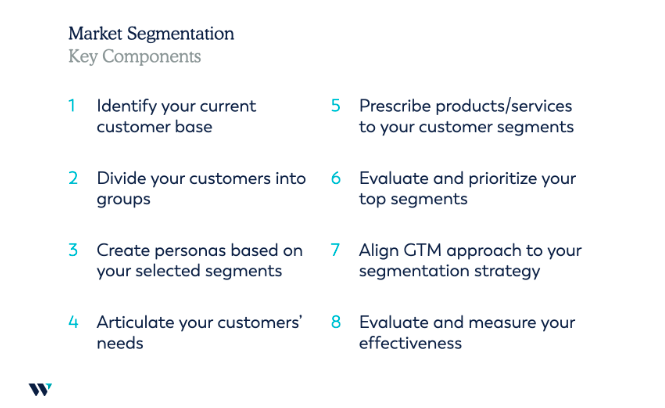

How to make market segmentation a discipline

B2B companies of all stages — from Series A to publicly traded companies — should be constantly analyzing and refining their market segmentation strategies. The first step is to put in place systems and tools that capture data across all touchpoints in the customer journey, from marketing to pre-sales to post-sales. Next, establish a dedicated resource for analyzing this data, along with frequent customer interviews and external market research. Create an internal go-to-market (GTM) team composed of the CEO, CRO, and other key leaders across core functions. The team should meet often to review where the company is winning, where it’s losing and pinpoint any changes needed in the segmentation strategy. Finally, firms should have a mechanism for executing these changes across the organization.

Market segmentation is never perfectly complete. You know you’ve zoomed in enough on a particular segment when an additional level of granularity doesn’t tell you anything new. And you’re in a good place if the segments you’re focusing on today function at a high velocity and at high margins relative to other opportunities. When considering new verticals or geographies, always ask whether resources applied against this new target profile could be better utilized growing share in an existing market, resulting in greater revenue or profitability. And even if the answer is “yes,” will entering this new market strategically benefit the company in some other way? The bottom line is that the process is never static: The key is to test your hypotheses against the data, customer conversations and market research and then iterate.

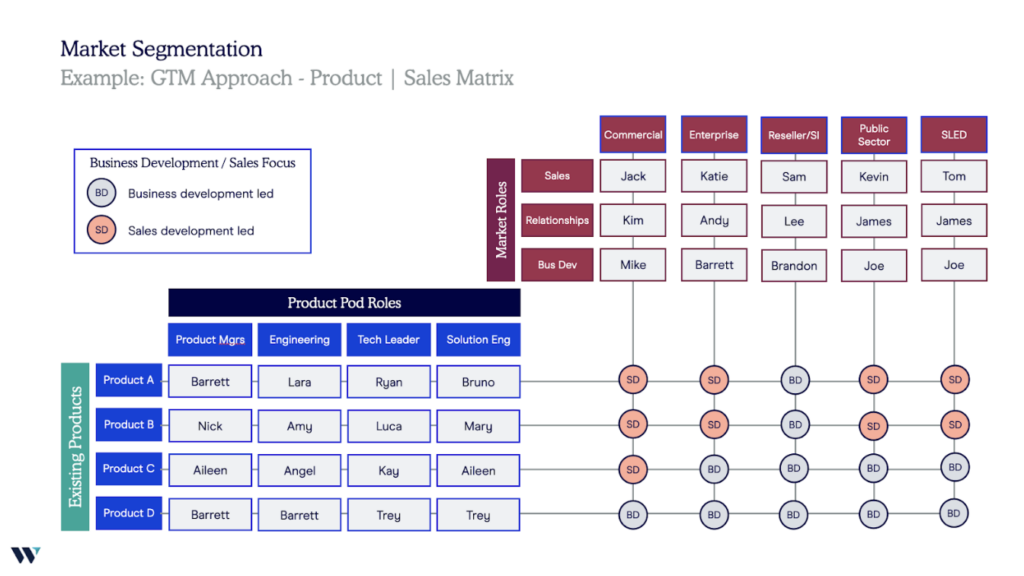

Prioritizing segmentation can lead to creative solutions. These exercises don’t always entail eliminating segments, but potentially deploying bespoke GTM strategies within existing segments. In a prior sales leadership role, I was part of a team that believed we were investing sizable resources trying to penetrate the lower end of the SMB segment, resulting in small deals with even smaller ROI. Management considered eliminating these customer profiles from our core market segmentation strategy. Instead, I proposed creating a new GTM approach for this segment, with a tailored pricing package that required fewer pre-sale resources, thus improving our projected ROI. By gaining clarity through our segmentation exercise, we learned that we didn’t need to pivot away from certain customers but could shift our strategy to improve margins. As a result, we were able to retain these customers as they grew in value over time, while also improving profitability.

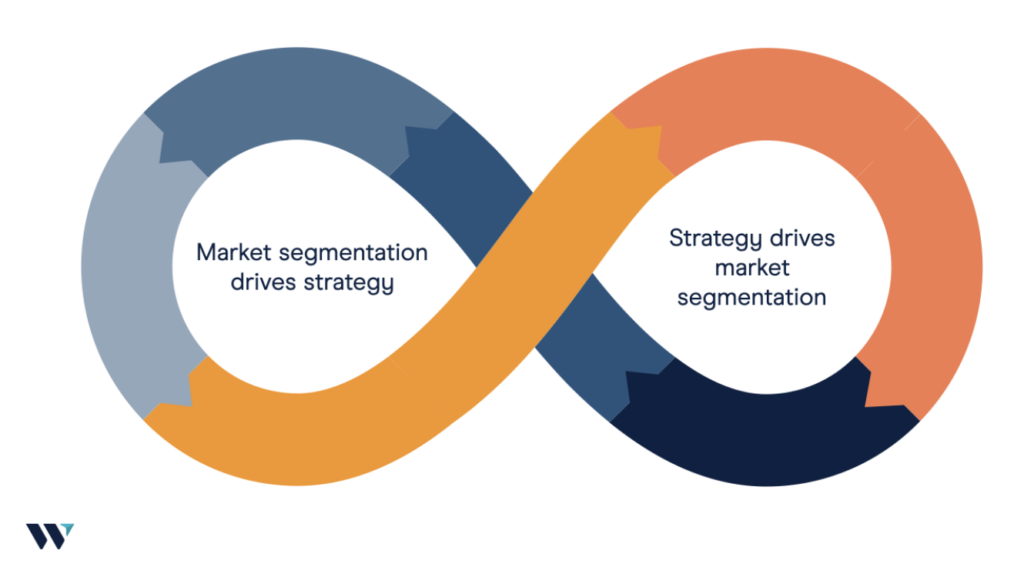

Adapting to unleash growth

While a company’s core business strategy often drives its segmentation strategy, the reverse can be true: A well-tuned segmentation strategy can actually inform and improve the overall business strategy. Change is a constant, and the same should be said for market segmentation. It is critical for B2B companies to keep a pulse on their target customers to ensure they’re serving their needs and driving value creation. By getting crystal-clear on their ideal customer profiles, B2B companies can precisely define themselves in the market, build brand awareness, close more deals and better serve customers. Teams can align internally, and resources can flow to where they’re most efficiently deployed. And companies can stay competitive at a time when customers are looking to do more with less.

At WestCap, we typically invest in growth-stage companies that have already established a product-market fit. So as part of our mission to help them unlock scale, we help management teams focus on their core audience while evaluating new opportunities and markets. Our team of experienced leaders across Marketing, Sales, Customer Success and beyond roll up their sleeves to help our portfolio companies put the right systems and processes in place to achieve their potential. Market segmentation may be fundamental, but it remains a critical piece of the puzzle.

About Nick Pompeo

Nick Pompeo is a Vice President at WestCap, serving the firm’s Strategic Operators Group. He leads WestCap’s Sales & GTM practice, partnering with its portfolio companies to accelerate revenue growth by helping build world-class sales teams that can execute at scale. Prior to joining WestCap in 2020, Nick led East Coast Sales at Looker, where he oversaw 10x ARR growth. Upon Google’s acquisition of Looker in 2019, he then helped lead and execute the GTM integration strategy between Looker’s and Google’s sales teams. Connect with Nick on LinkedIn.

The above is provided as an illustrative example and designed to demonstrate the benefits to portfolio companies of partnering with us. The information is aimed at prospective portfolio companies and not intended to solicit investors, or an offer to purchase any securities. The experiences highlighted may not necessarily represent or be indicative of current, past or future results and experiences with portfolio companies.